The Facts About Mileagewise - Reconstructing Mileage Logs Revealed

Table of ContentsFacts About Mileagewise - Reconstructing Mileage Logs UncoveredMileagewise - Reconstructing Mileage Logs for DummiesMore About Mileagewise - Reconstructing Mileage LogsThe Of Mileagewise - Reconstructing Mileage LogsNot known Factual Statements About Mileagewise - Reconstructing Mileage Logs 5 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownMileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

Timeero's Fastest Distance attribute recommends the shortest driving route to your employees' destination. This feature improves efficiency and contributes to cost financial savings, making it an essential asset for businesses with a mobile labor force.Such a technique to reporting and compliance simplifies the often complicated task of managing gas mileage expenditures. There are several benefits connected with making use of Timeero to keep track of gas mileage.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

These extra confirmation actions will maintain the IRS from having a factor to object your mileage documents. With precise mileage monitoring modern technology, your employees do not have to make rough gas mileage estimates or also stress about gas mileage expense tracking.

For instance, if a staff member drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all vehicle expenses. You will require to proceed tracking gas mileage for work also if you're making use of the real expense approach. Keeping mileage records is the only method to different organization and personal miles and give the proof to the internal revenue service

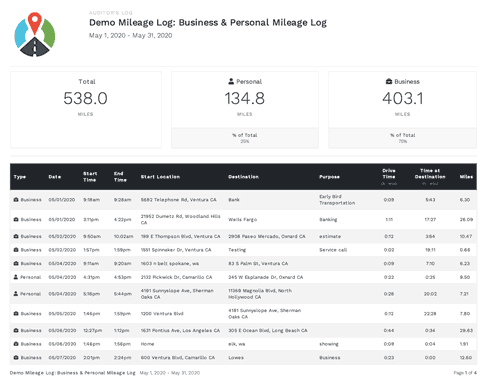

Most gas mileage trackers allow you log your journeys manually while determining the distance and compensation amounts for you. Lots of additionally featured real-time trip tracking - you require to start the app at the beginning of your journey and quit it when you reach your last destination. These apps log your start and end addresses, and time stamps, together with the complete range and repayment quantity.

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

This consists of costs such as fuel, maintenance, insurance coverage, and the car's devaluation. For these prices to be thought about insurance deductible, the lorry should be made use of for organization objectives.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

Begin by taping your automobile's odometer reading on January 1st and after that once again at the end of the year. In between, carefully track all your company journeys writing the starting and ending readings. For each and every trip, record the area and service function. This can be streamlined by keeping a driving visit your auto.

This includes the total organization gas mileage and total gas mileage build-up for the year (business + personal), journey's day, location, and purpose. It's important to record activities without delay and preserve a coeval driving log detailing date, miles driven, and company function. Below's exactly how you can enhance record-keeping for audit purposes: Beginning with making certain a thorough gas mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs Fundamentals Explained

The real expenses technique is an alternate to the standard gas mileage rate technique. As opposed to computing your deduction based upon a predetermined price per mile, the real expenditures method permits you to subtract the actual prices connected with utilizing your car for organization purposes - mileage tracker. These expenses consist of fuel, maintenance, fixings, insurance coverage, depreciation, and other relevant costs

Nevertheless, those with substantial vehicle-related expenses or distinct problems may gain from the real expenditures method. Please note choosing S-corp standing can change More about the author this computation. Eventually, your chosen approach needs to straighten with your details economic goals and tax scenario. The Criterion Mileage Rate is a procedure provided yearly by the IRS to establish the insurance deductible costs of running an automobile for company.

Our Mileagewise - Reconstructing Mileage Logs Statements

Maintaining track of your gas mileage by hand can require diligence, but bear in mind, it might save you money on your taxes. Tape-record the complete mileage driven.

The 7-Minute Rule for Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market became the initial business individuals of GPS. By the 2000s, the shipping market had actually taken on GPS to track plans. And now nearly everybody makes use of GPS to navigate. That means virtually every person can be tracked as they tackle their company. And there's snag.

Comments on “Rumored Buzz on Mileagewise - Reconstructing Mileage Logs”